ETH Price Prediction: Technical Breakout and Fundamental Catalysts Point to $5,500 Target

#ETH

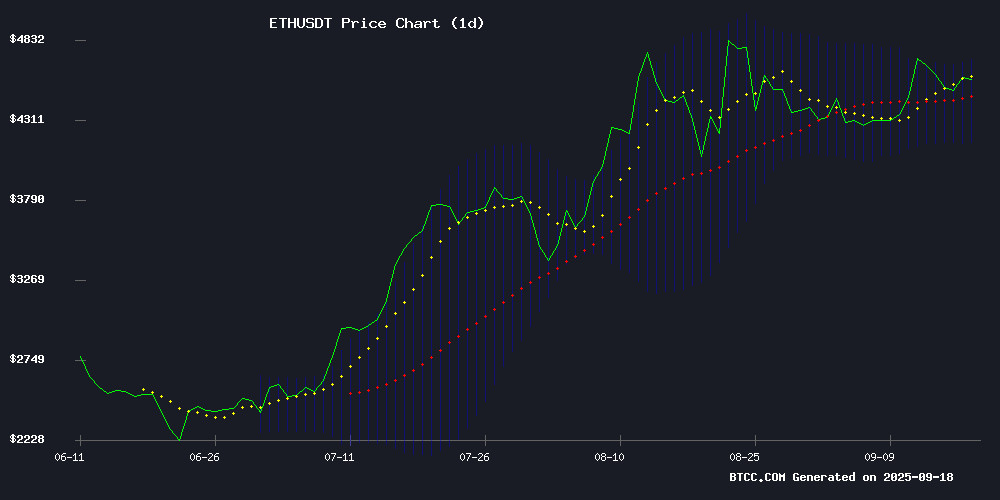

- ETH trading above 20-day MA indicates sustained bullish momentum

- Major partnerships and development updates provide fundamental support

- Technical targets align with analyst predictions of $5,500 by mid-October

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

ETH is currently trading at $4,580.94, firmly above its 20-day moving average of $4,432.28, indicating sustained bullish momentum. The MACD reading of -38.36 suggests some near-term consolidation, but the price holding above the middle Bollinger Band at $4,432.28 demonstrates underlying strength. According to BTCC financial analyst Emma, 'The technical setup supports continued upward movement, with the next key resistance NEAR the upper Bollinger Band at $4,703.18.'

Market Sentiment: Strong Fundamentals Support ETH's Bullish Outlook

Positive developments including ethereum whales' unrealized profits reaching 2021 cycle peaks, Vitalik Buterin's next-generation roadmap unveiling, and Google's partnership with Coinbase for stablecoin payments are driving optimistic sentiment. BTCC financial analyst Emma notes, 'The combination of institutional adoption through Google and fundamental improvements in Ethereum's technology creates a compelling investment thesis. Fundstrat's $5,500 price target by mid-October appears achievable given current momentum.'

Factors Influencing ETH's Price

Former Goldman Trader Draws Parallels Between VFX Token and Early Ethereum

A former Goldman Sachs trader with 15 years of experience has sparked interest in crypto circles by comparing VFX Token's trajectory to Ethereum's early days. The trader, who managed a $2 billion portfolio, noted that VFX Token's existing infrastructure—similar to Ethereum's foundational approach—sets it apart. Unlike Ethereum, which required years to develop smart contracts and DeFi applications, VFX Token launched with operational trading infrastructure, including live Visa and Mastercard integrations.

The comparison highlights VFX Token's tangible utility, with its presale priced at $0.05 and a projected launch price of $1.20. One trader on X emphasized the project's substance over meme-driven hype, calling attention to its institutional-grade forex access and licensed trading framework. With $1 million in total funding already secured, VFX Token is drawing institutional and retail interest alike.

Ethereum Whales' Unrealized Profits Reach 2021 Cycle Peaks, Signaling Potential Market Shift

Ethereum holders controlling between 10,000 and 100,000 ETH are sitting on unrealized profits matching November 2021 levels, according to CryptoQuant analysis. These 'medium whale' portfolios now mirror peak valuations from the last bull market's zenith.

Historical patterns suggest such profit thresholds often precipitate increased selling pressure. 'Large holders typically seek to lock in gains at these levels,' analysts noted, while cautioning this doesn't guarantee immediate price correction. The situation represents a critical psychological juncture where whale behavior could significantly influence ETH's trajectory.

Market observers note Ethereum recently tested the $4,630 resistance level following the Federal Reserve's 25-basis-point rate cut. A decisive breakout could propel prices toward $4,800, according to Bybit partner Lennaert Snyder.

Ethereum Price Tests Key Resistance Amid Record Unstaking Activity

Ethereum has surged past $4,520, eyeing the next critical resistance at $4,680. The recovery follows a breakout above a bearish trend line, with technical indicators flashing bullish signals—hourly MACD gaining momentum and RSI holding above 50. A decisive move above $4,750 could propel ETH toward $4,880.

Meanwhile, a record $12 billion worth of ETH sits in the unstaking queue, requiring 44 days to process. This unprecedented demand for liquidity coincides with a 116% spike in strategic reserves and ETF holdings since July. Institutional interest remains robust, with Ethereum ETFs attracting $646 million in inflows last week alone.

Ethereum Investors Turn to AIXA Miner for Daily Yield Amid Staking Limitations

Ethereum's transition to Proof-of-Stake eliminated traditional mining avenues, leaving holders with staking and trading as primary options—both constrained by lock-up periods and volatility. AIXA Miner positions itself as a frictionless alternative, offering cloud-based mining contracts requiring only a mobile device or computer.

The platform circumvents hardware costs and energy expenditures typical of GPU mining, targeting retail investors seeking passive income streams. While not directly tied to ETH's price action, the model capitalizes on growing demand for yield-generation tools in a low-activity market environment.

Vitalik Buterin Unveils Ethereum's Next-Generation Roadmap at Japan Conference

Ethereum co-founder Vitalik Buterin outlined a comprehensive roadmap for the network's evolution at the Japan Developer Conference, emphasizing scalability, privacy, and long-term security. The plan targets Layer 1 (L1) scaling without sacrificing decentralization, proposing an increased Gas limit and leveraging ZK-EVMs to enhance performance.

Layer 2 consolidation emerged as a priority, aiming to unify fragmented networks through trustless asset transfers and rapid finality protocols like 3SF. Privacy protections extend to both transaction data and user queries, with zero-knowledge proofs and mix networks shielding identities.

A newly formed dAI Team will position Ethereum as the foundational layer for AI economies, developing a decentralized AI stack for censorship-resistant agent interactions. The foundation's strategic pivot integrates machine learning infrastructure with blockchain's security guarantees.

Google Partners with Coinbase to Enable Stablecoin Payments for AI Applications

Google has unveiled an open-source protocol designed to facilitate payments between artificial intelligence applications, including transactions using stablecoins. The initiative, developed in collaboration with Coinbase, the Ethereum Foundation, and over 60 other companies, represents a significant stride toward integrating cryptocurrency with AI-powered services.

The protocol builds on Google's earlier Agent2Agent framework, aiming to standardize communication between AI agents while connecting them to decentralized finance protocols. Major participants include Salesforce, American Express, Etsy, PayPal, and several leading consulting firms.

Stablecoins have seen remarkable growth this year, with circulation surging from $205 billion to $289 billion. This protocol could further accelerate adoption by enabling autonomous transactions between AI systems.

Ethereum Gains Momentum as SEC Settlement Sparks Market Optimism

Ethereum's recent settlement with the U.S. Securities and Exchange Commission has ignited a wave of bullish sentiment across crypto markets. The resolution marks a pivotal moment for ETH, with prices rebounding sharply and 24-hour trading volumes exceeding $3 billion.

ProfitableMining emerges as a key beneficiary, attracting thousands of ETH holders to its cloud-based mining platform. The service reportedly generates daily earnings surpassing $7,800, offering passive income without hardware requirements or technical expertise. With 1.68 million users across 190 countries, the platform capitalizes on Ethereum's renewed institutional credibility.

Ethereum's DeFi Future Shifts to Layer-2 Networks Amid Liquidity and Innovation Boom

Ethereum faces a paradox as its native token, ETH, reaches record highs while layer-1 DeFi activity stagnates. August's mainnet fees plummeted 44% month-over-month to $44 million, signaling a stark contrast to late 2021's peak activity. Meanwhile, layer-2 solutions like Arbitrum and Base are flourishing, boasting $20 billion and $15 billion in total value locked respectively.

The ecosystem's evolution raises critical questions about whether L2s are cannibalizing Ethereum's DeFi dominance or forging a multi-layered financial architecture. AJ Warner of Offchain Labs argues that Ethereum's role is transforming into crypto's 'global settlement layer,' anchoring high-value institutional products like BlackRock's BUIDL and Franklin Templeton's tokenized funds—activities not fully reflected in traditional DeFi metrics.

Layer-2 networks, designed as scalable offshoots of Ethereum's secure but sluggish base layer, are increasingly becoming the engines of innovation and liquidity. This bifurcation underscores a maturing ecosystem where Ethereum L1 serves as the bedrock while L2s drive practical adoption.

Fundstrat Predicts ETH Rally to $5,500 by Mid-October Amid Market Correction

Ether (ETH) dipped 0.5% to $4,506 as of Sept. 16, with traders weighing whether the pullback sets the stage for another rally. Fundstrat's Mark Newton views the decline as a overdue correction, projecting resilience above $4,233 and identifying $4,375-$4,418 as buy zones. His mid-October target of $5,500 reflects confidence in ETH's underlying strength.

CoinDesk Research notes ETH's 3% drop on Sept. 15, with trading volume spiking to 501,741 units during a sharp hourly decline. The asset found support at $4,471 while facing resistance at $4,671—levels now serving as technical boundaries. Market participants are watching these thresholds for directional cues.

Is ETH a good investment?

Based on current technical indicators and market developments, ETH presents a strong investment opportunity. The price trading above key moving averages combined with positive fundamental catalysts suggests continued upward potential.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $4,580.94 | Bullish |

| 20-Day MA | $4,432.28 | Support Level |

| Upper Bollinger | $4,703.18 | Near-term Target |

| MACD | -38.36 | Consolidation |

BTCC financial analyst Emma emphasizes that 'the convergence of technical strength and fundamental improvements makes ETH an attractive investment at current levels.'